It’s now been a full 12 months since purchasing the last fourplex property, and I’ve learned a TON of stuff during this time. The buildings have mostly stabilized, and my personal involvement has shrunken down to just a few hours of work per month.

In this post I talk about property management, and share the systems/habits I use to stay on top of my business. I’ll also share my accounting practices and how I keep the financial records tidy.

Missed the first two posts? Find them here: Part 1 & Part 2

My Property Manager, aka “COO”:

There’s no way I’d be able to manage these fourplexes on my own. 16 different tenants, midnight complaints, work orders, late payments, disputes, etc… I get anxiety just thinking about it! I have hired an experienced property management company to handle all of the day-to-day operations.

“It takes teamwork to make the dream work”

I like to think of my property manager as the COO of my business. They report to me (CEO), run all operations, prepare finance reports, run/manage contractors, and have authority to make certain decisions on their own. Although the COO runs 90% of my company, I am responsible for 100% of the wellbeing and overall outcome.

Something I realized early in my investing career is that I don’t have to become an expert in everything. It’s more efficient to focus only on tasks that I’m good at, and hire out all other work to professionals who possess the skills that I lack. Dealing with tenants is a skill that I lack, which over time I learned the hard way by making mistakes.

Property Management Fees:

Close call… A neighbor’s tree fell down during a midnight storm, taking out power to my fourplexes. Luckily, it fell in the direction away from my complex and fences. Didn’t cost me anything!

I’ve heard investors complain about how much property management costs. In my opinion, property managers are worth every cent. For each hour they work, they save me an hour. I can use this saved time to focus on higher value activities.

My property manager charges 2 types of fees:

- Residual Management Fee: For these fourplexes I pay 7% of all incoming rent. This is slightly less than the typical market rate for the location. (For my other investment properties, I pay a 10% management fee, which I believe is quite standard across the US).

- New and Renewal Lease Commissions: This fee is a once off payment equal to ½ of 1 month’s rent, for signing new tenant leases or renewing existing ones.

All in all, I pay around $12,000 in fees to my property manager each year. That seems like a lot of money! But actually, it’s a very small price to pay for the amount of work they do.

Note to new investors: It’s important to include all these fees in your initial analysis before buying a rental property. Future post to come on analyzing deals!

Tips On Managing the Managers:

Some investors switch property management companies fairly regularly. When disagreements or issues arise, it’s easy to blame the property manager and replace them.

My view on property management is a little different. For every mistake or disagreement I have with my property manager, I see it as an opportunity for our relationship to grow stronger. Switching out a core member of my team comes at a very high transaction cost.

Here are some management and leadership techniques I use to get the most out of my property managers:

- Always be positive and fun: Whenever I call my prop manager (especially when I have a bad situation to discuss) the first thing I do is crack a joke. Or, ask how their day/week/month has been. Always starting on a positive note makes me their best and happiest client, and in return they treat me like family. They want to answer my calls and give me priority treatment.

- Lead by example: Before criticizing anything my PM does, I first criticize myself. If I want them to be the best property management company in the world, I first have to become the best owner/investor in the world. It’s only fair that I try as hard, if not harder, than them.

- High standards & trust: I hold everyone at my PM firm to the highest standards. Instead of saying things like, “When do you think you can fix this?”, instead I use phrases like, “I trust you will resolve this issue in the next 48 hours. Thanks.” Giving people tasks to live up to gets me better results than allowing them the chance to disappoint me.

- Stay out of their way: I try my best not to interfere with their decisions, even if I think they’re wrong. My PMs are hired to do a job, and there’s a reason they do things certain ways. It sucks giving up control sometimes, but it’s the only way I can scale and focus on expansion.

Related Post: Hiring a property manager? – Ask these questions!

Accounts and bookkeeping:

Owning a rental property is like owning a small business. And owning 4 x rental properties is like owning 4 x small businesses! My fourplexes have 4 x different mortgage payments (to different banks), 4 x insurance policies (different coverages & start/end dates), 4 x tax bills, various escrow accounts, different purchase prices, interest rates, rent incomes, occupancy rates, different ROI’s etc. etc. etc…

How does one keep track of it all?

I love spreadsheets, so I track every property individually and keep it strictly separate from my personal finances. I’ve also set up multiple bank accounts and maintain the appropriate cash reserves in each account.

Master Property Ledger:

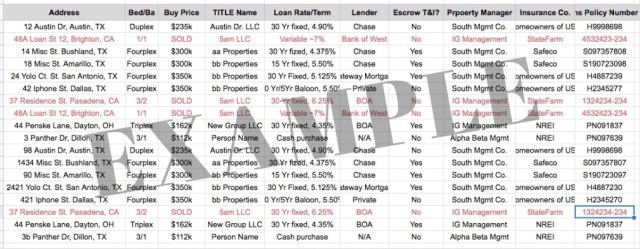

I keep a master list of the rental properties I own that records what type of property, who’s name they were purchased in, and responsibilities for tax/insurance/mortgage etc. I review/update this quarterly as part of my personal Quarterly Business Review.

There are some softwares out there built specifically for property owners, but I’ve never found one that suits me. I believe custom Excel or Google Sheets is the most common method used for investors with under ~20 properties (A common question on BiggerPockets). So, until my methods get out of control I will continue to use Excel. (Unless you have a better method you can recommend me?)

Monthly P&L Statements:

Around the 15th of each month my property manager emails me profit/loss statements. These statements detail all incoming rent and expenses for the previous month broken down by property and unit. I can see who has paid rent, who hasn’t, what maintenance was completed, any vacancies, and copies of all work order receipts.

I’ve gotten in the habit of reviewing every single detail on these statements, even if they’re 45 pages long. My goal is to find mistakes, pick up trends, and see if there any any areas of improvement. I also verify that the $ amounts all match up with what is transferred to my bank account(s).

I know many investors that skip this step because reviewing statements can be boring… This is a big mistake. Not reviewing monthly statements is kind of like a CEO not reading company revenue reports. Things can go downhill pretty quickly!

Separate Names, Accounts, Cashflows:

Some of my properties are in my personal name, some are joint names and some business names. For this reason I’ve created separate checking accounts for each fourplex, and record each account individually.

Each fourplex has a cash flow chart looking like this:

Why track each one individually?

- Winners/losers: Over time I may want to dispose of any bad performing properties. Separate tracking allows me to easily identify the money makers and the losers.

- Commingling funds is a big no no: For properties in an LLC, they must be kept completely separate from personal finances. Any commingling can lead to the LLC being pierced in a court of law and therefore the very protection the LLC provides is void.

- Clean P&L Statements: Separated annual statements make it easy for tax filing each year as well as proof of performance when selling properties to other investors.

Economies of Scale & Tips:

Bundle discounts are sometimes available by using the same vendors for certain bills. For example, I use the same national insurance company for all of my home insurance policies. This gives me a little cheaper bulk rate, as well as makes it easier to pay and track bills. I’ve also negotiated bulk discounts for appliances, A/C maintenance, and yard work across the fourplexes.

Matching mortgage payment dates makes accounting a little easier. I have set up all my mortgage payments to auto-deduct from their respective bank accounts on the 10th of each month. Accounting is easier this way.

Time consolidation has saved me a bunch. I used to spend 30 mins here and there every few days checking up on the properties. Instead, I now schedule set blocks of a few hours every month to handle everything at the same time. This takes some getting used to, but is definitely more time efficient.

Well, that’s it for now! Let me know if you have any questions.

Did someone really build an upside down house? Is it still standing? I’ve never seen anything like it. Pretty courageous to purchase something like this at such a young age!!

Thanks for the tips. I’m working on credit card receipts for 624!!

Thanks Debs! Good luck with it all – that’s a great project. Maybe we can take on something together in the future! 🙂